State Tax Credits: Expand Vermont Tax Credits to Help Vermonters Meet Their Basic Needs

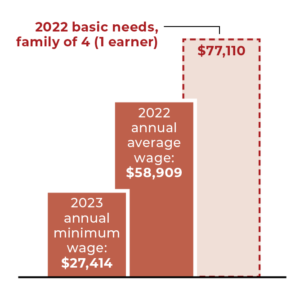

Over 10 percent of families with children live in poverty in Vermont, more than three times the percentage of families without children. Across the state, average wages alone don’t provide enough for families with children to meet their basic needs. The Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) are targeted, refundable tax credits, which help qualifying families fill in the gap between incomes and expenses by providing cash when they file their taxes. These credits have been proven to lift families out of poverty, with larger credits providing more substantial benefits. Vermont has been a leader in state-level anti- poverty tax credits, but restrictions on who qualifies as well as systemic barriers to access leave out many Vermont families who would benefit from the credits.

Over 10 percent of families with children live in poverty in Vermont, more than three times the percentage of families without children. Across the state, average wages alone don’t provide enough for families with children to meet their basic needs. The Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) are targeted, refundable tax credits, which help qualifying families fill in the gap between incomes and expenses by providing cash when they file their taxes. These credits have been proven to lift families out of poverty, with larger credits providing more substantial benefits. Vermont has been a leader in state-level anti- poverty tax credits, but restrictions on who qualifies as well as systemic barriers to access leave out many Vermont families who would benefit from the credits.

The Alliance supports the efforts of Public Assets Institute and other advocates to expand the Vermont EITC from matching 38% of the federal EITC to 55%, and to expand access to the Vermont EITC and CTC for families with low income who need them most. These changes will reduce poverty, improve family financial stability, and allow Vermonters to meet needs specific to their families.

Lead Organization: Public Assets Institute