Vice President Kamala Harris on April 29 began a multi-state Economic Opportunity Tour in Atlanta, Ga. directed at shoring up black voters in swing states who will be essential to President Joe Biden’s bid to reelected in November.

In Nov. 2020, in the last Economist-YouGov poll taken before the election, then-candidate Biden was viewed very favorably by 50 percent black voters and somewhat favorably by 28 percent—a total of 78 percent.

Only 10 percent of blacks felt somewhat unfavorable to Biden and 8 percent strongly unfavorable.

In contrast, in the latest Economist-YouGov poll taken in March, Biden’s approval among black voters has dropped significantly, to 66 percent—with only 28 percent strongly approving, and 38 percent somewhat approving.

The disapproval rate stands at a whopping 28 percent, with 10 percent somewhat disapproving and 19 percent strongly disapproving.

That’s a dramatic, marked change, and so Harris, who is half black, is being called in to at least attempt to mitigate some of the damage that has been caused largely by inflation the past few years, with 94 percent of black voters saying inflation and prices are important, including 77 percent who said it was very important. 21 percent said it was the most important issue, more than any other group.

When asked if they approved of Biden’s handling of inflation, only 57 percent of blacks said they did, with a whopping 35 percent disapproving. That’s a catastrophe for Biden.

Harris’ presentation in Atlanta was designed to play to the perceived strengths of the U.S. economy, including the low (but rising) unemployment rate, but failed to address the extremely high cost of living that is impacting households across the nation, including black households, thanks to the sticky consumer inflation that continues to outpace personal incomes.

Since Feb. 2021, consumer prices are up 18.5 percent, but personal income is still only up 17.6 percent, according to data compiled by the Bureau of Labor Statistics and the Bureau of Economic Analysis. Americans have not gotten ahead in the current economy.

And Harris largely ignored the issue in her open salvo on the Economic Opportunity Tour. In fact, the only mention of inflation per se was Harris’ mention of the so-called Inflation Reduction Act in passing, but not to tout the inflation rate, instead, it was to discuss subsidies and government spending from the legislation, saying, “what we are doing with the inflation reduction act which is about at least a trillion dollars invested in the climate but a clean energy economy…”

Harris added, “[O]ne of the compelling reasons for me to start this tour now and to ask all the leaders here for help in getting the word out about what is available to entrepreneurs and small businesses is because we are in the process of putting a lot of money in the streets of America for this growth.”

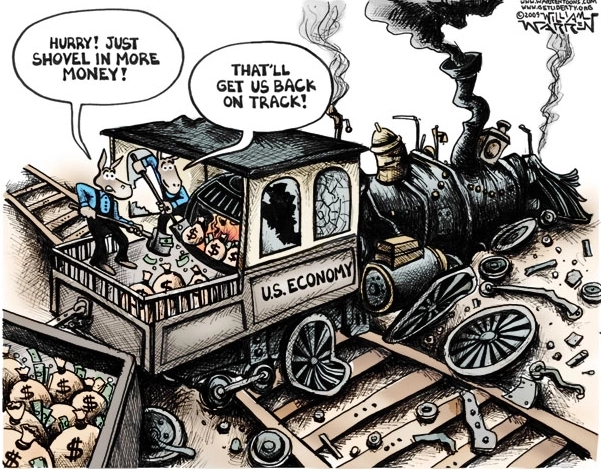

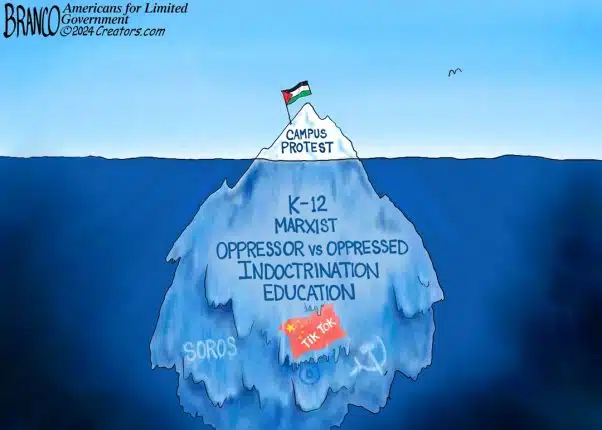

The irony of this is that government spending has largely been one of the greatest inflation drivers during this economic cycle, wherein almost $7 trillion was spent, borrowed and printed into existence in response to the Covid pandemic and its aftermath, in 2020 and in 2021 when Biden began office with another stimulus and even more spending with the Inflation Reduction Act.

Historically, large increases in the M2 money supply have preceded spikes in inflation, and 2021 and 2022 were no different.

And so, yes, Harris is technically correct, “we are in the process of putting a lot of money in the streets of America…”—and that’s how we got into this mess.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.