CEI Comments on Proposed SEC Rule: Enhancement and Standardization of Climate-Related Disclosures for Investors

Comments submitted by the Competitive Enterprise Institute et al.

June 17, 2022

In the matter of the proposed rule

“The Enhancement and Standardization of Climate-Related Disclosures for Investors”

Securities and Exchange Commission

87 FR 21334; RIN 3235-AM87; File No: S7-10-22

Comments Prepared by Marlo Lewis, Kevin Dayaratna, and Patrick Michaels

Thank you for the opportunity to comment on the Security and Exchange Commission’s proposal to require every registrant to provide more information about “climate-related risks” that are “reasonably likely to have a material impact” on the firm’s business, operations, or financial condition.[1] Please address any inquiries about these comments to Marlo Lewis, Senior Fellow, Competitive Enterprise Institute ([email protected]).

- Introduction: Objective Quantification of Climate Risks Is Often Impossible

The SEC’s proposed rule is the cutting edge of the environment, social, governance (ESG) movement’s campaign to align private capital investment with an aggressive climate policy agenda—one that aims to cut greenhouse gas (GHG) emissions dramatically by 2030 and achieve a net-zero emission economy by 2050.[2]

The proposed rule would require registrants to report the magnitude and probability of the financial losses they could incur due to (1) the physical impacts of climate change and (2) the companies’ “transition” and “liability” risks—the losses they may incur due to climate policies and litigation.

However, objective quantification and measurement of such risks is often impossible. Climate risk assessments depend on multiple assumptions fraught with uncertainties. Speculative risk guestimates are of little financial value to investors.

Boston University professor Madison Condon’s “Market Myopia’s Climate Bubble” (MMCB), an influential paper cited in the proposal,[3] describes some of the epistemological challenges:

Evaluating climate risk involves forecasting macroeconomic energy demand, guessing on the success of carbon regulation and future technologies, modeling the relationship between atmospheric gas concentrations and global temperatures, predicting how temperature rise will change the earth’s climate systems, and calculating how those changes impact physical economic assets. The task requires skills beyond that of a typical financial analyst, colossal amounts of data, and models that have only begun to be built. Each step of estimation adds layers of uncertainty to risk projections. In some cases, particularly those longer-term and macroeconomic, the estimation of the economic impact of climate change may be dwarfed by this uncertainty.[4]

Additional uncertainty arises from the vagaries of politics and litigation: “No amount of regulatory or corporate governance intervention can give shareholders and managers the ability to foresee the future—the outcomes of national elections, for example, are both largely uncertain and hugely influential in determining the strength of future climate policy.”[5]

MMCB therefore cautions against an “overemphasis on false precision provided by complicated models.” The author prefers the use of “fine-grained asset-level” analysis focused “on climate risks at the scale of individual corporations and investors and their horizons.” She suggests companies should at least be able to report on the “climate-related impacts we have already been experiencing.”[6]

However, even when assessing current impacts, speculative modeling comes into play. Consider Lights Out: Climate Change Risk to Internet Infrastructure,[7] the featured study in MMCB’s introduction. As summarized by MMCB, the study shows that on the U.S. East Coast, “thousands of miles of fiber optic cable, and more than a thousand nodes of key Internet infrastructure, could be underwater in the next 15 years.”[8] Alluding to the study a few pages later, MMCB criticizes “the continued neglect of assessing companies’ exposure to foreseeable climate risks,” describing “global sea-level rise over the next 15 years” as a phenomenon that “can be predicted with some certainty.”[9]

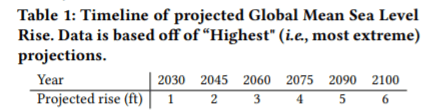

In fact, Lights Out is a cautionary tale of how dubious climate risk assessment can be. The study is based on a long-term (2018-2100) sea-level rise projection, which the authors call the “highest” and “most extreme” scenario. The scenario projects sea levels to rise 6 feet by 2100 and 1 foot by 2030:

Global mean sea-levels have risen 8-9 inches (21-24 centimeters) since 1880.[10] The Internet infrastructure risks forecast in Lights Out materialize only if sea levels increase by about 30 percent more during 2018-2030 than during the preceding 138 years. The current annual rate of global mean sea-level rise is 3.5 millimeters, according to the National Aeronautics and Space Administration (NASA).[11] Lights Out assumes a 2018-2030 rate of about 25.4 mm/year—more than seven times faster. In the National Oceanic and Atmospheric Administration’s (NOAA) recent sea-level rise report, one foot (0.31 meters) of sea-level rise is the upper end of the projected range in 2050, not 2030, and only in the “very high” emission scenario (SSP5.8.5).[12]

The lesson here is how easily junk science can beguile those predisposed to believe climate change is ‘worse than we thought.’ Lights Out sources its “extreme” scenario to “a collection of projected sea-level rise scenarios, flood exposures, and affected coastal counties, and is amassed from a number of partner organizations.” However, the accompanying footnote takes us not to sea-level rise scenarios, models, or data but to a list of the Web sites of 827 partner organizations.[13] The study is literally non-auditable.

Despite the plea for “granular” information,[14] climate risk disclosure advocates typically rely on overheated models run with inflated emission scenarios, producing scary but implausible warming forecasts.

In addition, the assessments often exaggerate the costs of climate change by depreciating mankind’s remarkable capacity for adaptation. For example, neither the SEC nor any of the reports it cites mentions the dramatic long-term decline in both weather-related mortality and the relative economic impact of extreme weather events. None acknowledges fossil fuels’ indispensable contributions to those improvements.

Because ESG advocates exaggerate the magnitude and certainty of climate change risks, they also exaggerate the political prospects of the NetZero agenda and, thus, the certainty (although not the magnitude) of the transition risks facing fossil-intensive companies. Contrary to what many ESG proponents claim, climate change is not a looming planetary disaster that precludes a future for the fossil-fuel industry. Moreover, in the United States, inflation, soaring energy prices, and energy security concerns have stalled the climate agenda on Capitol Hill.

On the other hand, the SEC ignores the risks ESG requirements and the NetZero agenda create for non-fossil-fuel-company shareholders and the economy. First, and most obviously, the pursuit of NetZero threatens to saddle America with high-cost unreliable energy, low economic growth, and increasing dependence on OPEC for hydrocarbons and China for energy transition minerals. Such conditions would make building wealth more difficult for many Americans.

Second, requiring corporate leadership to prioritize climate metrics and objectives is bound to dilute fiduciaries’ primary focus on financial metrics and objectives, which are what matter to most investors, as distinct from ideologically-motivated stakeholders.[15]

Third, the Commission cannot put its thumb on the scales without causing favored companies’ stock prices to rise above their fundamental value. President Biden wants the SEC, Treasury, and other agencies to channel “the flow capital toward climate-aligned investments and away from high-carbon investments.”[16] That is a recipe for creating a novel systemic risk for the financial industry—an ideologically-charged, mandate- and subsidy-fueled green investment bubble.

- Overview

The SEC approvingly cites several reports and numerous comments by prominent ESG advocates.[17] However, the Commission seems unaware of the questionable premises on which much of that literature is based. We aim to remedy that oversight here. The studies informing and underpinning the SEC’s proposal:

- Favor climate risk assessments based on warm-biased models run with warm-biased emission scenarios.

- Attribute to climate change damages that chiefly reflect societal factors such as increases in population and exposed wealth.

- Overlook the increasing sustainability of our chiefly fossil-fueled civilization.

- Assume away the power of adaptation to mitigate climate change damages.

- Underestimate the resilience of financial markets to climate-related risks.

- Exaggerate the political prospects of the NetZero agenda.

- Ignore the vast potential of climate policies to destroy jobs, growth, and, thus, shareholder value.

- Overlook the economic, environmental, and geopolitical risks of mandating a transition from a fuel-intensive to a material-intensive energy system.

- Downplay the regulatory impediments to building a “clean energy economy.”

- Ignore the systemic risk their own advocacy efforts could create—an ideologically-charged, mandate- and subsidy-fueled “green” investment bubble.

Those flawed analytic practices are prevalent in climate policy advocacy in general. The SEC’s proposal would be unimaginable apart from those widespread assumptions and decisions. The SEC’s (mostly) implicit reliance on egregiously biased methodologies renders the proposed rule vulnerable to challenge as arbitrary and capricious.

The SEC rule is predicated on the assumption of an impending climate crisis. The alleged scientific verity of looming planetary disaster is the core justification for compelling publicly traded companies to prioritize “climate-related risks” not only in their SEC filings but also in their business models, planned expenditures, and corporate governance.

Unfortunately, the proposed rule overlooks the methodological flaws on which the climate crisis narrative is based. In Administrative Procedure Act (APA) terms, the rule ignores several “important aspect[s] of the problem.”

In Sections IV, V, and VI, we outline the foundational role of hot models, inflated emission scenarios, and gloomy adaptation assumptions in official climate impact assessments such as the Intergovernmental Panel on Climate Change (IPCC) reports. In Section VII we document the same pattern in ESG advocacy, including reports or experts cited by the SEC.

Read full comment here.

[1] Securities and Exchange Commission (“SEC,” “Commission”), The Enhancement and Standardization of Climate-Related Disclosures for Investors, 87 FR 21334, April 11, 2022, https://www.govinfo.gov/content/pkg/FR-2022-04-11/pdf/2022-06342.pdf.

[2] The SEC explicitly mentions one or both targets at 87 FR 21336, 21337, 21341, 21349, 21345, 21360, 21376, and 21406, and mentions the 1.5°C warming limit, the ostensible goal of the NetZero target, at 87 FR 21336, 21337, 21356, 21357, 21358, 21423, 21449, 21466, and 21468.

[3] 87 FR 21361, fn. 291; 21368, fn. 361.

[4] Madison Condon, Market Myopia’s Climate Bubble, SSRN, May 15, 2021, pp. 10-11, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3782675 (hereafter MMCB).

[5] MMCB, p. 7.

[6] MMCB, pp. 11, 16, 50.

[7] Ramakrishnan Durairajan, Carol Barford, Paul Barford. 2018. Lights Out: Climate Change Risk to Internet Infrastructure. Proceedings of the Applied Networking Research Workshop 9, https://ix.cs.uoregon.edu/~ram/papers/ANRW-2018.pdf.

[8] MMCB, p. 3.

[9] MMCB, p. 7.

[10] Rebecca Lindsey, “Climate Change: Global Sea Level,” NOAA Climate.Gov, January 21, 2021, https://www.climate.gov/news-features/understanding-climate/climate-change-global-sea-level.

[11] NASA Global Climate Change, Sea Level, Latest Measurement, accessed May 12, 2022, https://climate.nasa.gov/vital-signs/sea-level/. NASA reports there was 102.3 millimeters of sea-level rise from January 1993 to January 2022.

[12] NOAA et al. Global and Regional Sea Level Rise Scenarios for the United States, February 2022, https://aambpublicoceanservice.blob.core.windows.net/oceanserviceprod/hazards/sealevelrise/noaa-nos-techrpt01-global-regional-SLR-scenarios-US.pdf. See Figure 23, below.

[13] NOAA, Digital Coast, Contributing Partners, https://coast.noaa.gov/digitalcoast/contributing-partners/.

[14] 87 FR 21361.

[15] Commissioner Hester M. Peirce, “We Are Not the Securities and Environment Commission: At Least Not Yet,” March 21, 2022, https://www.sec.gov/news/statement/peirce-climate-disclosure-20220321.

[16] The words quoted are from President Biden’s Executive Order on Tackling the Climate Crisis at Home and Abroad, January 27, 2021, https://www.whitehouse.gov/briefing-room/presidential-actions/2021/01/27/executive-order-on-tackling-the-climate-crisis-at-home-and-abroad/.

[17] The comments cited were in response to Acting Chair Allison Herren Lee’s request for information, “Public Input Welcome on Climate Risk Disclosures,” March 15, 2021, https://www.sec.gov/news/public-statement/lee-climate-change-disclosures.

Read the full comment here.